TeliApp featured in NJ Tech Weekly – Check Fraud No Match for the Draconis AI Engine, Teliapp’s Joshua Weiss Says

Esther Surden, a journalist at NJ Tech Weekly, quotes our CEO Joshua Weiss in an article discussing how to use artificial intelligence to battle check fraud.

Check Fraud No Match for the Draconis AI Engine

Most people in the financial industry understand that check fraud is a gigantic problem for banks. Even in this era of electronic payments, check fraud is a trillion dollar problem worldwide.

In particular, consumers are often being approached by a “Nigerian prince,” or some equivalent, and many fall for the scam. “It’s an incredible amount of money lost over the years, and the problem is not going away. The numbers are rising,” Joshua Weiss, founder and CEO of TeliApp (Linden), told us.

These scams work like this: Criminals profile you to see if you’re a likely candidate for the scam. Then they make you an offer. For example, someone just out of college might receive an offer of a job online, perhaps to be a remote executive assistant to an international businessperson. Posing as the employer, the scam artist offers him a $3,000/month salary.

When the “employee” receives the first check, however, it’s for $4,000. The fake employer then asks the employee to wire $1,000 back via Western Union. The check has already been deposited in the bank and is available for withdrawal, so the employee goes ahead and transfers the funds. The next day, the check bounces, and the scammed employee has overdrawn his account.

To combat this problem, TeliApp developed an artificial intelligence (AI)/deep machine learning solution called “Fraud Detect” that is fine-tuned to detect fraud before banks and consumers are caught irretrievably in the crosshairs of scammers. The solution significantly reduces this type of check fraud, and helps mitigate synthetic identity fraud and money laundering.

The AI engine “cannibalizes all of your data, understands your trends and behaviors, knows the things you spend money on and your deposit history,” so it can detect anomalies very quickly.

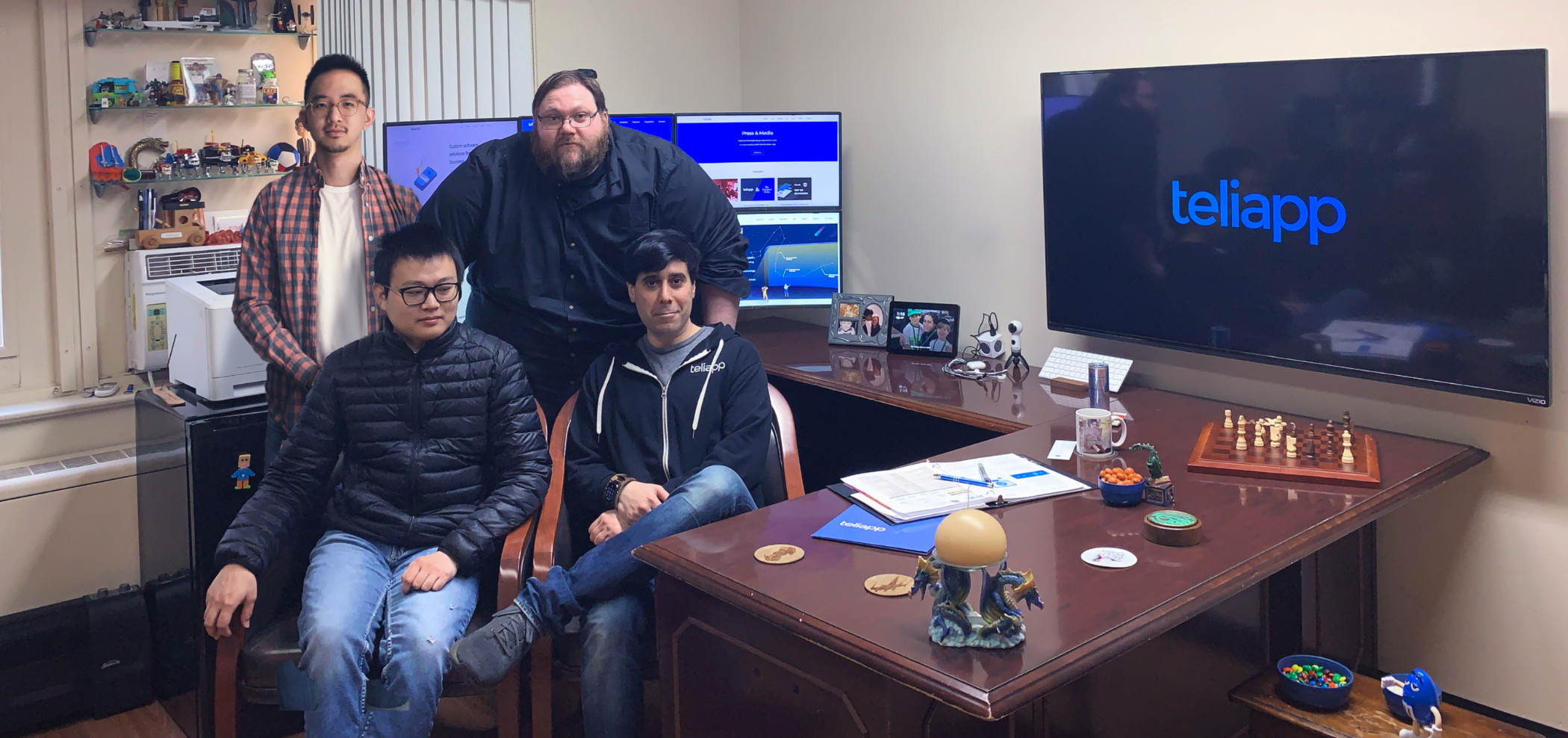

Joshua Weiss of TeliApp